Promoting Financial Independence Through Interactive Learning

- Jakub K.

- Nov 21, 2025

- 4 min read

Updated: Dec 2, 2025

In today's fast-paced world, achieving financial independence is a goal many aspire to. However, the traditional methods of learning about finance often fall short, leaving individuals feeling overwhelmed and unprepared. Interactive learning offers a fresh approach, making financial education engaging and effective. This blog post explores how interactive learning can promote financial independence, providing practical examples and actionable steps to help you on your journey.

Understanding Financial Independence

Financial independence means having enough savings, investments, and cash on hand to afford the lifestyle you want for yourself and your family. It’s about having the freedom to make choices without being constrained by financial limitations. Here are some key components of financial independence:

Savings: Building a robust savings account is essential. Aim for at least three to six months' worth of living expenses.

Investments: Investing in stocks, bonds, or real estate can help grow your wealth over time.

Debt Management: Reducing and managing debt is crucial. High-interest debt can hinder your ability to save and invest.

Budgeting: Creating and sticking to a budget helps you track your income and expenses, ensuring you live within your means.

The Role of Interactive Learning

Interactive learning transforms the way we acquire knowledge. Instead of passive listening, it encourages active participation, making the learning process more engaging and effective. Here are some benefits of interactive learning in financial education:

Enhanced Retention: Engaging with the material helps improve memory retention. When learners participate in discussions or activities, they are more likely to remember the information.

Real-World Application: Interactive learning often involves simulations or case studies that mimic real-life scenarios, allowing learners to apply concepts in a practical context.

Collaboration: Working with peers fosters collaboration and the sharing of ideas, which can lead to a deeper understanding of financial concepts.

Immediate Feedback: Interactive platforms often provide instant feedback, helping learners identify areas for improvement and reinforcing their understanding.

Examples of Interactive Learning Methods

To effectively promote financial independence, consider incorporating the following interactive learning methods into your educational journey:

Workshops and Seminars

Participating in workshops and seminars can provide hands-on experience with financial concepts. These events often feature experts who share their knowledge and facilitate discussions. For instance, a workshop on budgeting might include activities where participants create their own budgets based on hypothetical income and expenses.

Online Courses with Interactive Elements

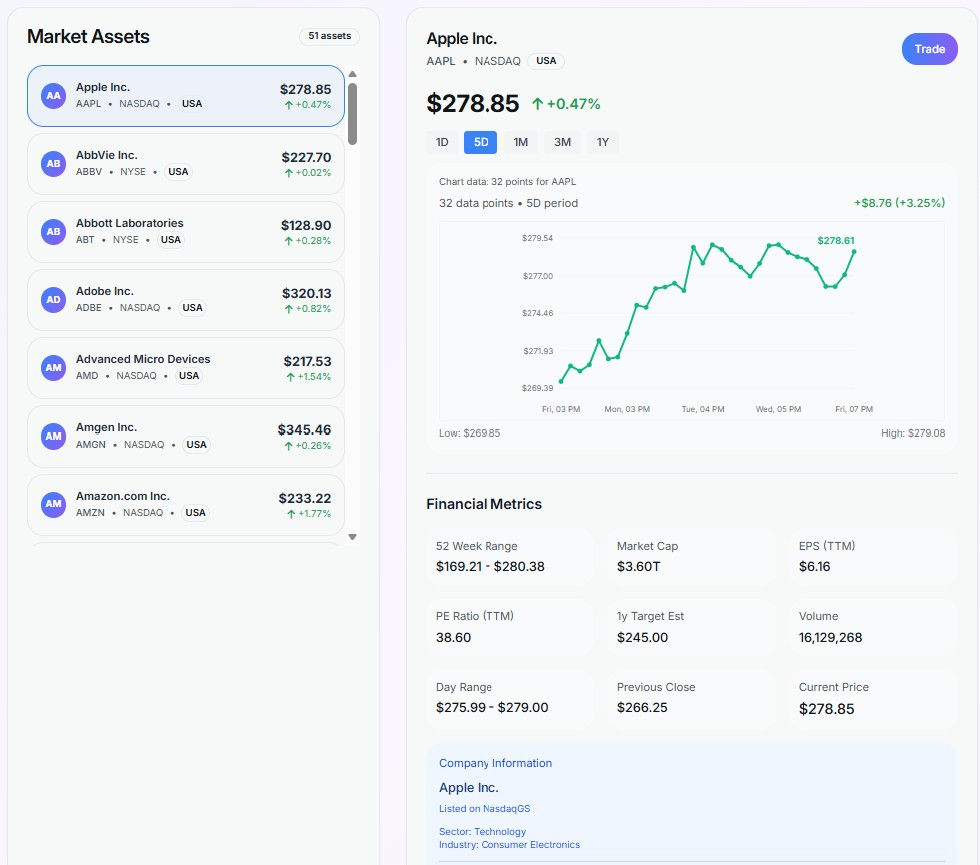

Many online platforms offer courses that include quizzes, discussion boards, and interactive simulations. Websites like Coursera and Udemy provide courses on personal finance that allow learners to engage with the material actively. For example, a course on investing might include a stock market simulation where learners can practice buying and selling stocks in a risk-free environment.

Financial Literacy Games

Games can be a fun and effective way to learn about finance. Board games like "Monopoly" or digital games like "Cashflow" teach players about money management, investing, and the consequences of financial decisions. These games encourage strategic thinking and can spark discussions about financial independence.

Peer Learning Groups

Forming or joining a peer learning group can provide a supportive environment for discussing financial topics. Members can share their experiences, challenges, and successes, fostering a sense of community. This collaborative approach can help individuals stay motivated and accountable in their pursuit of financial independence.

Practical Steps to Implement Interactive Learning

To make the most of interactive learning in your financial education, consider the following steps:

Identify Your Learning Style

Understanding your preferred learning style can help you choose the most effective interactive methods. Are you a visual learner who benefits from videos and infographics? Or do you prefer hands-on activities? Tailoring your learning approach can enhance your experience.

Set Clear Goals

Establish specific financial goals to guide your learning journey. Whether it's saving for a down payment on a house or paying off debt, having clear objectives will help you stay focused and motivated.

Seek Out Resources

Look for workshops, online courses, and games that align with your financial goals. Many organizations and platforms offer free or low-cost resources to help you get started.

Engage with Others

Join forums, social media groups, or local meetups focused on financial education. Engaging with others can provide valuable insights and support as you work towards financial independence.

Reflect on Your Learning

Take time to reflect on what you've learned and how you can apply it to your financial situation. Keeping a journal or discussing your insights with a peer can reinforce your understanding and help you stay accountable.

Overcoming Challenges in Financial Learning

While interactive learning offers many benefits, there can be challenges along the way. Here are some common obstacles and how to overcome them:

Information Overload

With so many resources available, it can be overwhelming to know where to start. Focus on one topic at a time and gradually expand your knowledge.

Fear of Failure

Many people hesitate to engage with financial concepts due to fear of making mistakes. Remember that learning is a process, and mistakes are often valuable learning opportunities. Embrace the journey and view challenges as chances to grow.

Lack of Time

Finding time for financial education can be difficult, especially with busy schedules. Consider setting aside a specific time each week for learning, even if it's just 30 minutes. Consistency is key.

The Future of Financial Education

As technology continues to evolve, the landscape of financial education is changing. Interactive learning methods are becoming more accessible, allowing individuals to take control of their financial education. Here are some trends to watch:

Virtual Reality (VR) Learning

VR technology is beginning to be used in financial education, providing immersive experiences that simulate real-world financial scenarios. This innovative approach can enhance understanding and retention.

Mobile Learning Apps

Mobile apps that focus on financial literacy are gaining popularity. These apps often include interactive quizzes, budgeting tools, and investment simulations, making learning convenient and engaging.

Personalized Learning Experiences

As data analytics improve, personalized learning experiences tailored to individual needs and preferences are becoming more common. This approach can help learners focus on areas where they need the most support.

Conclusion

Promoting financial independence through interactive learning is not just a trend; it’s a necessary shift in how we approach financial education. By embracing interactive methods, individuals can gain the knowledge and skills needed to achieve their financial goals. Whether through workshops, online courses, or peer learning groups, the key is to engage actively with the material. Start your journey today, and take the first step towards financial independence.

Remember, the path to financial freedom is a marathon, not a sprint. Stay committed, keep learning, and watch your financial confidence grow.

Comments