Teach Kids Budgeting Skills with Engaging Stories

- Jakub K.

- Nov 21, 2025

- 4 min read

Updated: Dec 4, 2025

Teaching children about budgeting can seem like a daunting task. However, using engaging stories can make this important life skill both fun and memorable. By weaving lessons into captivating narratives, kids can learn the value of money, saving, and spending wisely without feeling overwhelmed. This blog post will explore how to effectively teach kids budgeting skills through storytelling, providing practical examples and tips along the way.

The Importance of Budgeting for Kids

Understanding budgeting is crucial for children as it lays the foundation for their financial literacy. Here are some key reasons why teaching budgeting is essential:

Promotes Financial Responsibility: Kids learn to manage their money, which fosters a sense of responsibility.

Encourages Saving: Budgeting teaches the importance of saving for future needs and wants.

Prepares for Real-Life Situations: Children who understand budgeting are better equipped to handle financial decisions as adults.

Builds Confidence: Mastering budgeting skills can boost a child's confidence in managing their finances.

Using Stories to Teach Budgeting

Stories have a unique ability to capture attention and convey complex ideas in a relatable way. Here’s how you can use storytelling to teach budgeting skills:

Create Relatable Characters

Introduce characters that kids can relate to. For example, a young girl named Mia who wants to buy a new bike can serve as a central character. Through her journey, children can learn about budgeting as she navigates her financial decisions.

Develop a Plot with Financial Challenges

Craft a storyline where characters face financial challenges that require them to budget. For instance, Mia could receive a birthday gift of $50 and must decide how to allocate her money between saving for the bike and spending on other fun activities.

Incorporate Lessons on Saving and Spending

As the story unfolds, include lessons on saving and spending wisely. Mia might learn that if she saves a portion of her money each week, she can reach her goal faster. This can illustrate the concept of delayed gratification, an important aspect of budgeting.

Use Engaging Scenarios

Create scenarios that are both entertaining and educational. For example, Mia could encounter a friend who wants to buy a video game. This situation can lead to discussions about whether to spend money on immediate desires or save for something more significant.

Practical Examples of Budgeting Stories

Here are a few examples of stories you can create or share with children to teach budgeting skills:

The Lemonade Stand Adventure

Plot: A group of friends decides to set up a lemonade stand to earn money for a school trip. They must budget for supplies, set prices, and decide how to allocate their earnings.

Lessons:

Cost Analysis: Teach kids to calculate the cost of supplies versus potential earnings.

Profit Sharing: Discuss how to divide profits among friends and the importance of fair distribution.

The Birthday Party Dilemma

Plot: A child wants to throw a big birthday party but has a limited budget. They must decide on the number of guests, food, and entertainment within their budget.

Lessons:

Prioritization: Help kids understand how to prioritize their spending based on what is most important to them.

Creative Solutions: Encourage brainstorming of cost-effective ideas, such as DIY decorations or potluck-style food.

The Saving Challenge

Plot: A child sets a goal to save for a new toy. They create a savings plan and track their progress over several weeks.

Lessons:

Goal Setting: Teach the importance of setting specific savings goals.

Tracking Progress: Show how to keep track of savings and celebrate milestones along the way.

Tips for Engaging Kids in Budgeting Stories

To make budgeting stories more engaging, consider the following tips:

Interactive Storytelling: Encourage kids to participate in the storytelling process. Ask them how they would handle certain situations or what decisions they would make.

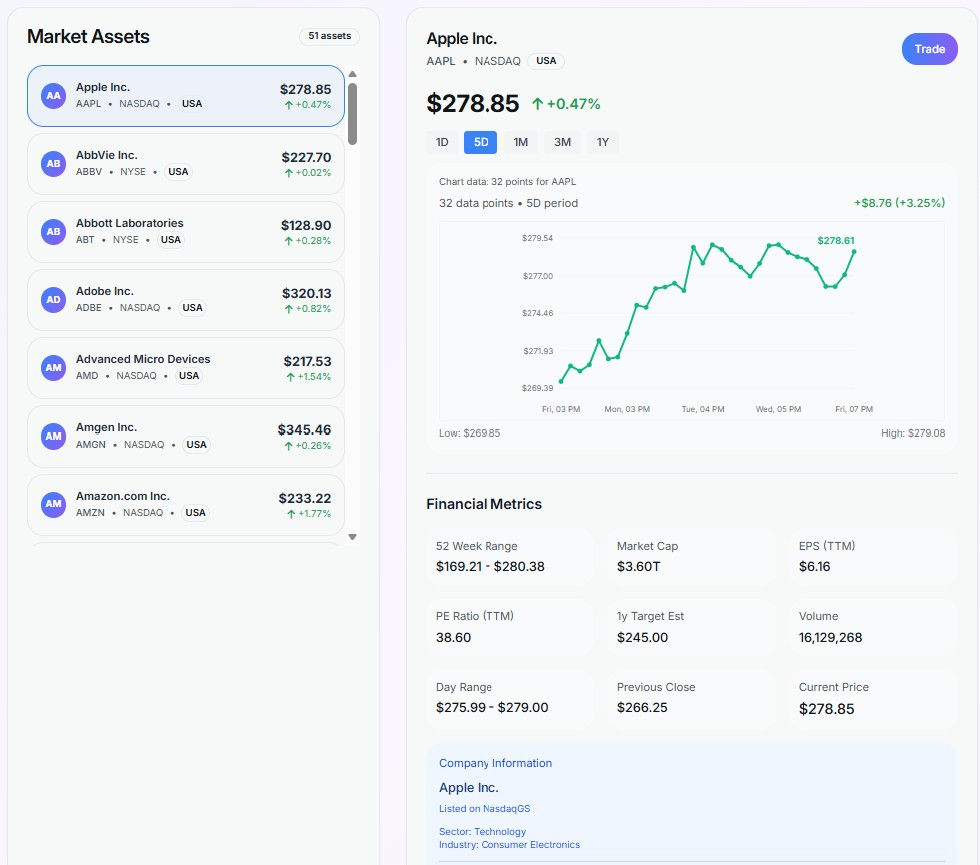

Use Visual Aids: Incorporate charts or drawings to illustrate budgeting concepts. For example, a simple pie chart can show how to allocate money for different expenses.

Relate to Real-Life Experiences: Connect the stories to real-life situations that kids may encounter, such as saving for a toy or planning a family outing.

Encouraging Real-Life Application

Once kids have engaged with budgeting stories, it's essential to encourage them to apply what they've learned in real life. Here are some ways to do this:

Set Up a Savings Jar

Create a savings jar where kids can physically see their money grow. This visual representation can motivate them to save more.

Involve Them in Family Budgeting

Include children in family budgeting discussions. Show them how you allocate money for groceries, bills, and savings. This transparency can help them understand budgeting in a practical context.

Create a Budgeting Game

Turn budgeting into a fun game. Use play money and create scenarios where kids must make spending decisions based on a set budget. This hands-on approach reinforces learning through play.

Conclusion

Teaching kids budgeting skills through engaging stories is an effective way to instill financial literacy. By creating relatable characters, developing plots with financial challenges, and incorporating practical lessons, children can learn the importance of budgeting in a fun and memorable way. Encourage them to apply these skills in real life, and watch as they grow into financially responsible individuals.

By making budgeting a part of their everyday lives, you are setting them up for a successful financial future. Start today by sharing a story, creating a budget together, or even setting up a savings challenge. The earlier they learn these skills, the better prepared they will be for the financial decisions that lie ahead.

Comments